Top 10 Women Independent Directors in Insurance - 2025

The insurance industry is undergoing a pivotal shift toward stronger governance, transparency, and ethical stewardship, and at the forefront of this evolution are women independent directors who bring diverse expertise, unbiased oversight, and a deep commitment to responsible growth. As insurers navigate complex regulatory environments, digital transformation, climate-related risks, and evolving customer expectations, the presence of women in independent board roles has become more significant than ever. Their perspectives - shaped by backgrounds in finance, law, public policy, healthcare, technology, education, and social impact - strengthen board deliberations and enhance the industry’s ability to make well-balanced strategic decisions.

Women independent directors contribute meaningfully to key governance functions such as risk management, audit, customer protection, ESG oversight, and long-term value creation. Their role is not confined to compliance; instead, they help shape the organization’s ethical framework, reinforce accountability, and ensure that insurers operate in a manner aligned with stakeholder interests. Many also champion gender diversity, inclusive workplace policies, and community-oriented initiatives, helping insurance companies build stronger social responsibility profiles.

In an industry historically dominated by technical and actuarial perspectives, these leaders bring a broader, more holistic view - one that prioritizes resilience, sustainability, and customer trust. Their presence on insurance boards reflects a larger trend: organizations increasingly recognize that balanced leadership leads to better governance and improved performance. As more women take on independent directorships across life, general, and health insurance companies, they are helping shape the strategic direction of the sector and paving the way for a more inclusive and forward-thinking future for insurance.

In this issue, the Women Entrepreneurs Review magazine brings a list of ‘Women Independent Directors in Insurance - 2025', who are domineers of change in the corporate realm of the country. This list of ten leading and inspiring women is crafted by a team of CEOs, VCs, and the editorial board, delivering inspiring stories of their journey and the contributions & roles played by them in the creation and empowerment of an economically powerful nation.

-

-

Apurva Purohit, Independent Director, Mumbai

She has over three decades of experience in the corporate world, during which she has forged significant partnerships with private equity firms and promoters to build and scale a diverse portfolio of businesses

-

-

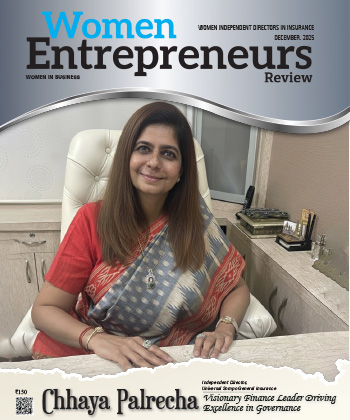

Chhaya Palrecha, Independent Director, Mumbai

With over three decades in finance and governance, she has built a reputation for steering organizations through growth and transformation, leveraging her expertise in compliance, MIS, and financial strategy

-

-

Jyoti Narang, Independent Director, Mumbai

She brings expertise in corporate governance, risk management, and strategic advisory, contributing to the bank’s growth and compliance excellence

-

-

Meena Jagtiani, Independent Board Director, Mumbai

She has over 35 years of multi-sectoral, cross-functional, and geographically diverse experience with leading organizations and has worked with senior leaders across consumer, manufacturing, and more

-

-

Nina Chatrath, Independent Director, Morarka Finance

She focuses on unlocking organizational capabilities through business and behavioral interventions and on building the strategic momentum of the business by collaborating closely with leaders

-

-

Padmaja Chunduru, Independent Director, Bangalore

A financial services executive with over 35 years of experience in banking, capital markets, and regulatory affairs, with specialized expertise in corporate lending and credit management

-

-

Punita Kumar Sinha, Independent Director, Mumbai

A senior investment professional with over 30 years of experience in investment management across emerging and international markets, she has led teams and business units focused on Asian equity funds

-

-

Rachna Dikshit, Independent Director, Gurgoan

She has experience in life insurance, including marketing, personnel, investment, CRM, information technology, corporate planning, regulatory compliance, actuarial, housing finance, group business, and more

-

-

Ramadevi Kasivajjula, Independent Director, Chennai

She brings expertise in corporate governance, risk management, and strategic oversight, contributing to the company’s robust growth and regulatory compliance

-

-

Usha Sangwan, Independant Director, Mumbai

With experience in operations, marketing, customer relations, and strategic leadership, she has played a key role in strengthening the firm’s governance and long-term growth