Tax Benefits of Health and Life Insurance Plans in India

By: WE Team | Monday, 7 April 2025

Health and life insurance policies provide dual benefits to Indian citizens. They provide financial protection during contingencies and are useful tax planning tools. The policyholders are eligible for tax benefits under the Income Tax Act.

This guide highlights health insurance tax benefits and how policyholders can effectively use life insurance plans and term insurance policies for tax planning. Continue reading to learn more!

Tax Benefits of Health Insurance Plans

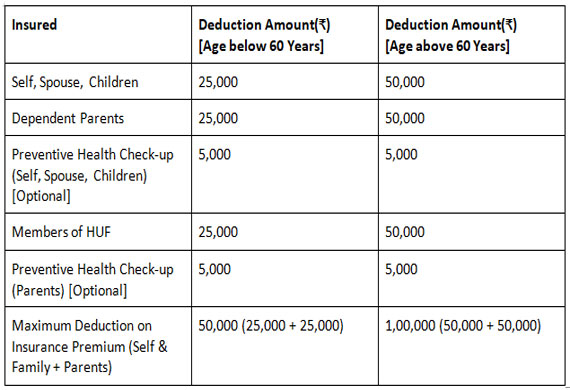

All health insurance plans provide tax benefits as the premium paid towards these plans is eligible for tax deduction. Section 80D of the Income Tax Act allows deductions of up to ₹1,00,000 in a financial year. Apart from a deduction on premiums, it also enables preventive health check-up deductions.

You can claim deductions for a health insurance policy bought for yourself, your spouse, your children and your parents. Members of a Hindu Undivided Family(HUF) can also claim deductions under this section.

Here are the deduction limits one can claim under Section 80D according to age group:

- Preventive health check-up deduction is allowed only if your total insurance premium

paid does not exceed the maximum permitted deduction limits for any of the above categories. - The maximum deduction allowed for individuals and families is ₹25,000, and for senior citizens, it is ₹50,000. This deduction also includes the amounts spent on preventive health check-ups.

- Health insurance is generally not available for people over 80. Therefore, a deduction of ₹50,000 is allowed annually, even if the money is spent on treatment rather than premiums.

Documents Required to Claim Tax Benefits Under Section 80D

Here are the documents required as proof for claiming health insurance tax benefits u/s 80D:

- The receipt for the premium payment is available on the insurer's website after you complete the payment.

- Ensure the date mentioned on the receipt falls within the financial year you claim the tax deduction.

- The receipt should also show the amount and mode of payment.

- Cash receipts are not eligible for deduction.

- Temporary receipts given by agents can’t be used to claim deductions.

Things to Remember While Availing Tax Deductions under Section 80D

Here are a few things to understand before claiming a tax deduction u/s 80D:

- The benefits offered u/s 80D are in addition to those provided u/s 80C.

- Carefully understand the tax exemptions provided in your health insurance policy.

- To be eligible for the deduction, the premium must be paid through any non-cash method, except for preventive health check-ups.

- Preventive health check-ups are eligible for deduction on a per financial year basis.

- If you fully pay your health insurance premium, you will be eligible for tax benefits for the entire policy duration.

Life Insurance and Term Insurance Tax Benefits in India

The Income Tax Act provides many tax benefits to policyholders who have invested in a life or term insurance policy. Check them out below:

●Section 80C

Under this section, you can claim tax benefits on a life insurance policy, endowment plan, whole life insurance plans, money-back policies, term insurance plans, and Unit-linked Insurance Plans (ULIPs). The maximum deduction allowed under this section is ₹1,50,000 per financial year for premiums paid. However, the premium amount should be less than 10% of the sum assured.

Benefits are entitled to premiums paid on insurance policies taken for oneself, one's spouse, dependent children, and parents.

●Section 10(10D)

Under this section, the tax is exempt on the proceeds received upon the maturity of life insurance and term insurance policies. The tax benefit applies to the receipt of the sum assured, bonus, maturity value, surrender value, and death benefit.

Tax Benefits at Various Stages of a Life Insurance Policy

Here is how you can save taxes at different stages of a life insurance plan:

●Entry Stage

In this phase, you can claim tax deductions on your premiums paid under sections 80C, 80CCC and 80CCD(1) of the Income Tax Act.

●Earnings Stage

Your investment in the life insurance policy will grow with time. They are not taxable.

●Switching Stage

You can switch your investments between debt, equity and balanced funds anytime. These switches are not taxable.

●Exit Stage

The payouts received on maturity of the plan are exempt from taxes under section 10(10D), subject to certain conditions, under the same section.

Investment in insurance policies will protect you during uncertain times and help you save on taxes, accelerating wealth creation in the long run. Both life and health insurance plans are necessary for effective tax planning and financial security against unforeseen circumstances.

To make an informed choice, research and compare different insurance plans based on parameters such as premiums, policy terms, and coverage amount.

Most Viewed

- 1 Women's Health Startup HerMD Closing Doors Amid Industry Challenges

- 2 5 Famous Women in Indian Armed Forces

- 3 Saudi Women No longer Require Male Permission for Clothing Choices, says Prince MbS

- 4 Kolkata Medtech Startup Innovodigm Raises Rs 5.5 Crore Seed Funding Led by IAN Group

- 5 Yamunanagar's Kashish Kalra Honoured after Securing 111th Rank in UPSC Civil Services Exam

- 6 Madurai Appoints Its First Woman Corporation Head

- 7 IAS Vijayalakshmi Bidari Appointed as the new Nagpur Divisional Commissioner

- 8 American Entrepreneur Lucy Guo Overtakes T Swift to become Youngest Female Billionaire

- 9 ICC Women's World Cup 2025 Trophy Showcased at Indore's Holkar Stadium

- 10 Aparna Saxena's Beauty Venture AntiNorm Launches in India

- 11 Vidya Nataraj Co-Founded BlueStone Jewellery & Lifestyle files IPO

- 12 5 Women Freedom Fighters of India

- 13 Dr. G Krishnapriya appointed as CEO for Trichy

- 14 M3M & Sirona Partner to Introduce Menstrual Hygiene Vending Machines in 15 Locations

- 15 Punjab Govt launches SHE Cohort 3.0 Supporting Tech-led Women Startups

- 16 Indian origin Lawyer, Sweena Pannu appointed as the US New Superior Court Judge

- 17 The Aurora Tech Award recognizes 4 Indian Women-led Startups

- 18 Kerala's Republic Day parade featured an all-female tableau

- 19 Manisha Kabbur Becomes Karnataka's First Woman International Karate Coach

- 20 Director K. S. Ravikumar's Daughter Maalica Ravikumar Launches Life Coaching Company 'Evergrowth Academy' for Women

- 21 Leezu's Raises Pre-Seed Funding to Accelerate Growth in Sexual Wellness Industry

- 22 Sattu: Super-easy summer drink for PCOS gut healing

- 23 Swathi Nelabhatla creates Sitha App, India's First Women-Exclusive Gig Platform

- 24 7 Timeless Female Kathak Dancers & their Iconic Legacies

- 25 Meet 7 Iconic Women Architects of Modern India & their Most Impactful Work

- 26 This Woman-led Insuretech Startup is Helping Bridge the Education Financing Gap in India

- 27 Women Leaders Share Lessons Learnt from India Women's WC Win

- 28 5 Enterprising Women Founders Powering Singapore's Tech & Innovation Landscape

- 29 4 Women. 4 Stories. One Vision for Smarter, Stronger Healthcare

- 30 Global Gender Gap Narrows to 68.8%, But Full Equality 123 Years Away: WEF Report 2025

- 31 Changemakers: 7 Women Entrepreneurs Taking the Make in India Movement Forward

- 32 Meet Lucy Guo, The Youngest Self-Made Female Billionaire Disrupting Tech

- 33 How Women are Driving India's Festive Online Shopping Surge